Inconsistency between AIRB and IFRS 9 PD modelling requirements

In recent years, new regulations with respect to credit risk models were published at a fast pace. Consistency between data sources, definitions and model methodologies were important topics for a number of guidelines from the regulators. This led to an intensified relation between the models for the two most important fields of application with respect to credit risk models: RWA calculation and provisioning.

Many banks decided to develop AIRB and IFRS9 models combined. Currently, the market seems to evolve into developing one probability of default (PD) base ranking model that will be calibrated differently for AIRB (through the cycle, TTC) and IFRS9 (point in time, PIT) purposes. Banks that decided to make two separate models for these purposes had a hard time to explain their choice to the regulator.

One could argue that a low-risk client under AIRB will probably be a low-risk client under IFRS9 as well. Therefore, multiple ranking models, with, likely, different ranking outcomes would lead to counterintuitive results. However, is the combination of the development of both models as straightforward as it seems?

This blog will focus on one specific inconsistency between the AIRB and IFRS9 requirements that led to challenges during our latest model development and many sleepless nights for me personally.

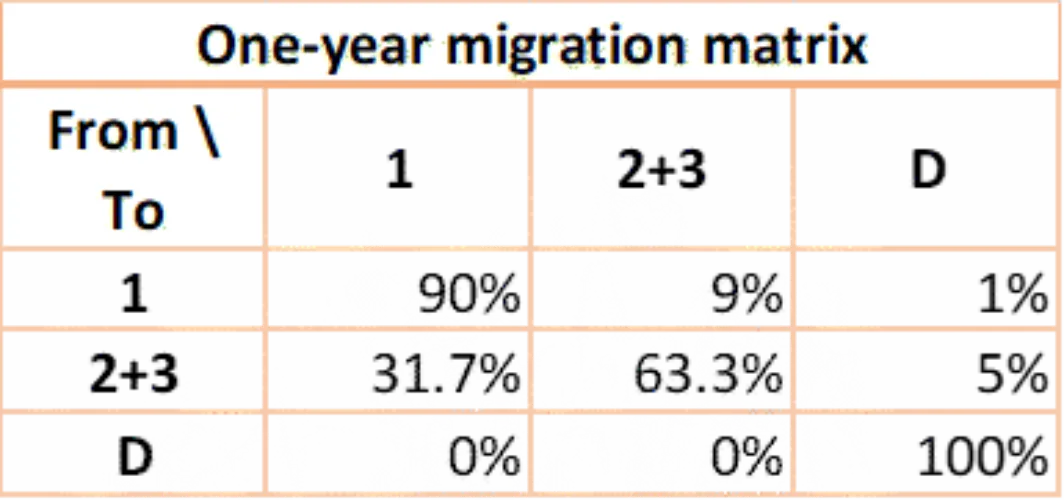

On the one hand we have the development of the IFRS9 multi-year PD model. The model is required to estimate the lifetime PD of the loan given the current and future state of the macroeconomy. This is a complex requirement, especially given limited data history. Therefore, it is market practice to calculate one-year PIT migration matrices and multiply them to obtain the multi-year PIT PD. However, the matrices should be Markov in order to achieve correct multi-year horizon estimates. The Markov property implies, in this context, that the probabilities of a set of possible rating migrations only depends on the current rating and is therefore independent on the full rating migration history.

On the other hand, there is the heterogeneity requirement for pooling of the AIRB models. This means that all pools should have a significantly different observed PD. However, the significant difference will be tested on the AIRB horizon, which is one year. This mismatch in horizon is exactly where the shoe pinches. Two facilities with the same one-year PD could have a different multi-year PD. However, due to the requirement of heterogeneity they will be merged into one pool, which leads to non-Markov properties of the migration matrix. This non-Markov behavior leads to problems in the development of the IFRS9 model.

The description of the inconsistency can be illustrated by the following example. Assume the following start population and the (true) migration matrix:

Note that this is in line with reality where most of the clients are healthy and have a low PD. Note that these numbers have been chosen to minimize the period of convergence of the observed default frequency (ODF), see the figure below:

With this start population we can calculate the number of defaults that we will observe over a five years period. In the first year 19 defaults will be observed. The distribution of the facilities over the ratings can be calculated in the same way. In year 2, rounded to an integer, 20 defaults will be observed and in years 3-5 every year 18 defaults will be observed (also rounded to an integer). In total we observe 93 defaults over the first five years. This number can also be obtained by multiplying the migration matrix 5 times with itself:

The expected number of defaults in five years is calculated as: 1000 × 0.071+120 × 0.134 + 60 × 0.103 = 93(rounded). Note that this three-state process is observed and will be estimated if all information is available.

However, the one-year default probability of rating 2 and rating 3 are equal. Therefore, based on the heterogeneity requirement from AIRB, these ratings will be merged into one rating. This leads to the following matrix (given the start population of rating 1, rating 2, rating 3 and default [1000,120,60,0]):

If we look at the number of estimated defaults in the first and the second year, we see an exact match with the three-state matrix (both estimated and observed). However, from the third year onwards, the number of estimated default for the two-state matrix is higher. After 5 years we estimate 99 defaults, instead of 93. Therefore, merging these two states leads to non-Markov behavior.

It is interesting to see that a one state model would be Markov, due to the chosen equilibrium population. Note that this would not be the case in real life, because there would be no equilibrium. However, usually the default probabilities are linked to the macroeconomy. Therefore, the one state model can be used for multi-year PD, without failing the Markov test. Note that a ranking model, with only one rating would be Markov, but would not meet any other requierements and is therefore not a solution.

Note that the example seems odd, but in practice these types of state traveling happen a lot. For example if there are separate ratings for facilities that currently have arrears, facilities that had arrears in the past 12 months and clients that did not have arrears in the past 12 months. In reality the observations are a combination of all kinds of patterns.

Preferably, as a modeler I would like to have:

- The same ranking model for both AIRB and IFRS9

- Heterogenic buckets under AIRB requirements

- Pass the Markov test on the migration matrix for IFRS9

From the example, it can be concluded that it is impossible to fulfill all three requirements. Therefore, we have to choose two. In our vision it depends on the specific situation at the client what would be the best choice. It is market practice to go for 1 and 2 and apply scaling to compensate for non-Markov matrices. This could be a good approach given that multi-year IFRS9 is only used for stage 2 facilities. Furthermore, the majority of the ECL will be based on the risk in the first years where the deviation is small and we are able to improve by scaling. However, if the bank uses the IFRS9 models also for extensive stress testing then not only the default probability is relevant, but also the performing-to-performing migrations, the bank might want to choose another strategy.

We as RiskQuest are always open to discuss the best strategy for your bank.

For more information on this topic contact Janneke van Schijndel (Manager) or Sven de Man (Partner)

If you want to join our RiskQuest team, please check our current job openings here